Recipes Rack: Your Culinary Haven

Explore a world of delicious recipes, cooking tips, and culinary inspiration.

Trading Digital Assets: The New Gold Rush or a Bubble Waiting to Burst?

Discover if trading digital assets is the next big gold rush or just a bubble ready to pop. Don’t miss out on this hot debate!

Exploring the Potential: Are Digital Assets the Future of Investment?

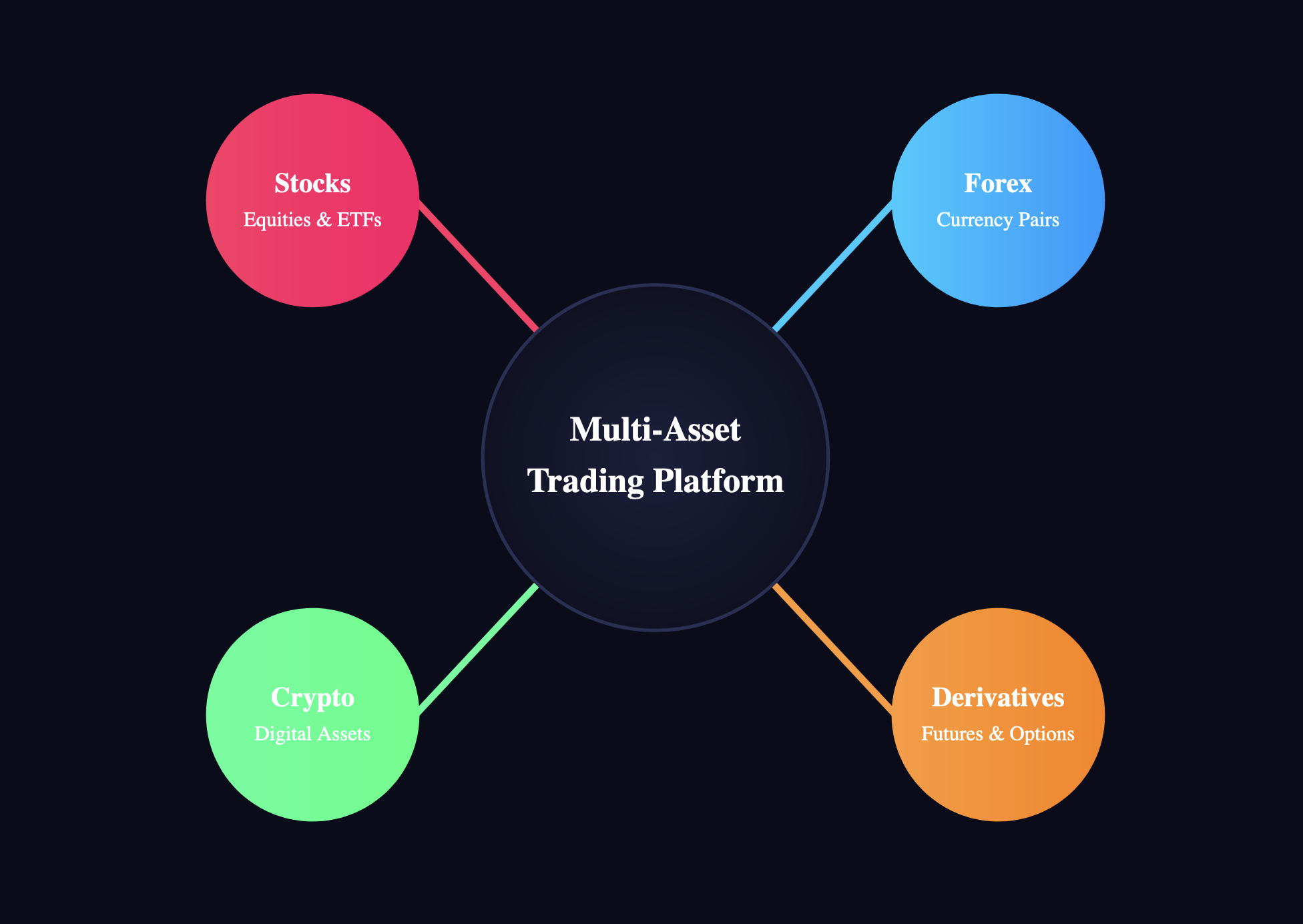

The world of finance is rapidly evolving, and one of the most intriguing developments in recent years is the rise of digital assets. Digital assets, including cryptocurrencies, NFTs, and various tokenized forms of value, have captured the attention of both individual and institutional investors. A key advantage of digital assets is their ability to be easily traded and accessed globally, providing unprecedented liquidity and market reach. Furthermore, the underlying technology of blockchain adds a layer of transparency and security that traditional assets often lack, making digital investments not only modern but also potentially more reliable.

As we explore the potential of digital assets as the future of investment, it's crucial to consider several factors. First, the volatility often associated with cryptocurrencies can result in significant gains but also substantial losses. Investors should conduct thorough research and adopt a diversified approach, much like they would with traditional investments. Additionally, regulatory developments will play a significant role in shaping the landscape for digital assets. As regulations become clearer, institutional investors may feel more comfortable participating in this space, further legitimizing digital assets as a viable investment option that can coexist with traditional forms of wealth.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in a battle of strategy and skill. Players must work together to complete objectives, whether it’s defusing bombs or rescuing hostages. For gamers looking to enhance their experience, using a daddyskins promo code can provide valuable in-game items and skins.

Digital Assets vs. Traditional Investments: Where Should You Put Your Money?

When considering digital assets versus traditional investments, it's essential to understand the unique characteristics and potential benefits of each. Digital assets, such as cryptocurrencies or NFTs, offer a decentralized investment option that can provide significant returns in a relatively short period. Their liquidity and 24/7 trading hours allow investors to react quickly to market changes. However, the volatility associated with digital assets poses a higher risk, which means investors should be prepared for sudden price fluctuations.

On the other hand, traditional investments, like stocks, bonds, and real estate, are generally considered more stable and secure. These assets have a long history of generating returns and are often less susceptible to drastic market shifts. Investors can benefit from diversification within traditional investment portfolios to mitigate risks, often allowing for steady growth over time. Ultimately, the decision of where to put your money depends on your financial goals, risk tolerance, and investment timeline.

Is the Digital Asset Market a Sustainable Boom or Just Hype?

The digital asset market has seen unprecedented growth over the past few years, attracting both seasoned investors and newcomers alike. Proponents argue that this surge signals a sustainable boom, driven by technological advancements and increasing acceptance of cryptocurrencies and blockchain technology in various sectors. As traditional financial systems adapt to this new landscape, many believe that digital assets are becoming integral to global commerce. However, this rapid expansion raises questions about its long-term viability and the potential for market correction in the face of underlying economic factors.

On the other hand, skeptics of the digital asset market contend that much of the current excitement is merely hype, fueled by speculation and social media trends. The lack of regulatory frameworks and inherent volatility contribute to ongoing concerns about the stability of this emerging market. Furthermore, instances of fraud and security breaches have sparked debates about the trustworthiness of digital assets. To truly determine whether the digital asset market is a sustainable boom or just another bubble waiting to burst, careful analysis of market trends, investor behavior, and regulatory developments is essential.