Recipes Rack: Your Culinary Haven

Explore a world of delicious recipes, cooking tips, and culinary inspiration.

Digital Asset Trading: Profits, Pitfalls, and the Pursuit of Pixels

Unlock the secrets of digital asset trading! Discover profits, pitfalls, and how to navigate the pixel pursuit for success.

Understanding Digital Assets: A Beginner's Guide to Trading

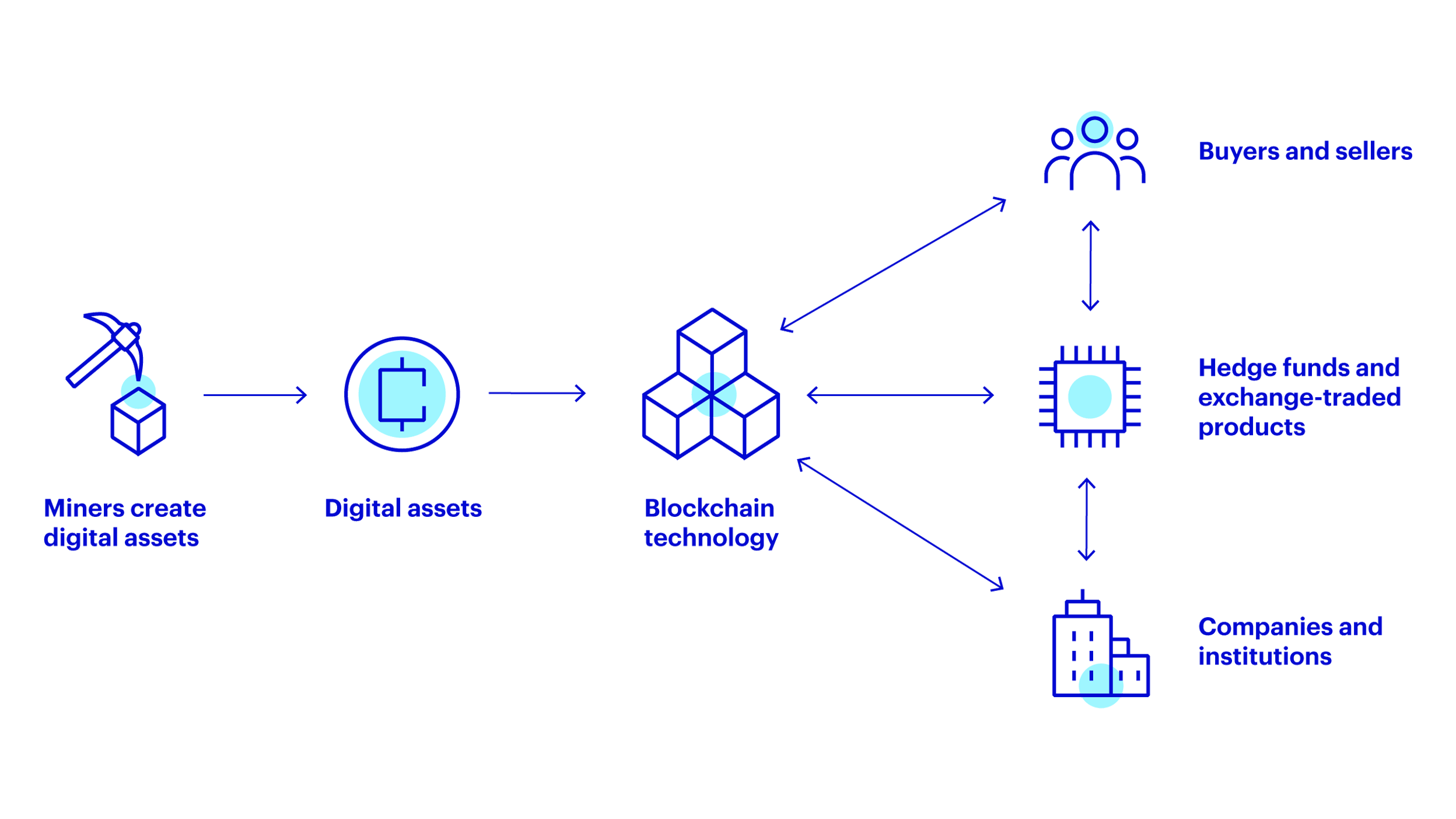

In today's digital world, understanding digital assets is crucial for anyone looking to trade or invest online. Digital assets include cryptocurrencies, tokens, and various forms of digital media that hold value. Unlike traditional assets, digital assets operate on blockchain technology, providing transparency and security. Before you dive into trading, it's essential to familiarize yourself with key concepts such as wallets, exchanges, and market fluctuations. Trading digital assets requires a solid strategy, as market conditions can change rapidly, making knowledge and research pivotal for success.

To get started, consider following these steps:

- Research available digital assets and their potential.

- Choose a reputable exchange to set up your trading account.

- Understand the significance of cryptocurrencies and how they differ from traditional investments.

- Start with small investments to mitigate risk while you learn the ropes.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players rely on teamwork, strategy, and precision to outsmart their opponents and achieve victory. For those looking to enhance their gameplay experience, using a daddyskins promo code can provide valuable in-game items and boosts.

Maximizing Profits in Digital Asset Trading: Strategies That Work

Maximizing profits in digital asset trading requires a strategic approach that encompasses thorough market analysis, risk management, and the implementation of effective trading strategies. One such strategy is employing technical analysis to identify buy and sell signals based on historical price data. Traders can enhance their decision-making by utilizing tools like moving averages, Fibonacci retracements, and relative strength index (RSI) to gauge market trends. Moreover, understanding market sentiment can provide crucial insights; staying informed through reputable news sources and social media can be pivotal in anticipating market shifts.

Another vital aspect of maximizing profits in digital asset trading is developing a solid risk management plan. This includes setting clear exit points and using stop-loss orders to protect capital from unforeseen market movements. Diversification is also key; spreading investments across various digital assets can minimize risks while exposing traders to more profit opportunities. Finally, continuously educating oneself about new technologies and trading tactics is essential for long-term success in this rapidly evolving space.

Common Pitfalls in Digital Asset Trading: How to Avoid Costly Mistakes

Engaging in digital asset trading can offer significant opportunities, but it also comes with its own set of challenges. Many traders fall into common pitfalls that can lead to substantial financial losses. One major mistake is ignoring market research. Without thorough analysis, traders risk making impulsive decisions based on emotions rather than data. Additionally, failing to set clear trading goals can lead to overtrading or investing more than one can afford to lose, which can exacerbate losses.

Another frequent misstep is the lack of risk management strategies. Traders often underestimate the importance of setting stop-loss orders, which can help mitigate losses during volatile market conditions. It's also crucial to avoid following the crowd; trading based purely on speculation or herd mentality can be detrimental. Prioritize educating yourself about various digital assets and developing a solid trading plan. By being aware of these common pitfalls and taking proactive measures, you can enhance your chances of success in the volatile world of digital asset trading.