Recipes Rack: Your Culinary Haven

Explore a world of delicious recipes, cooking tips, and culinary inspiration.

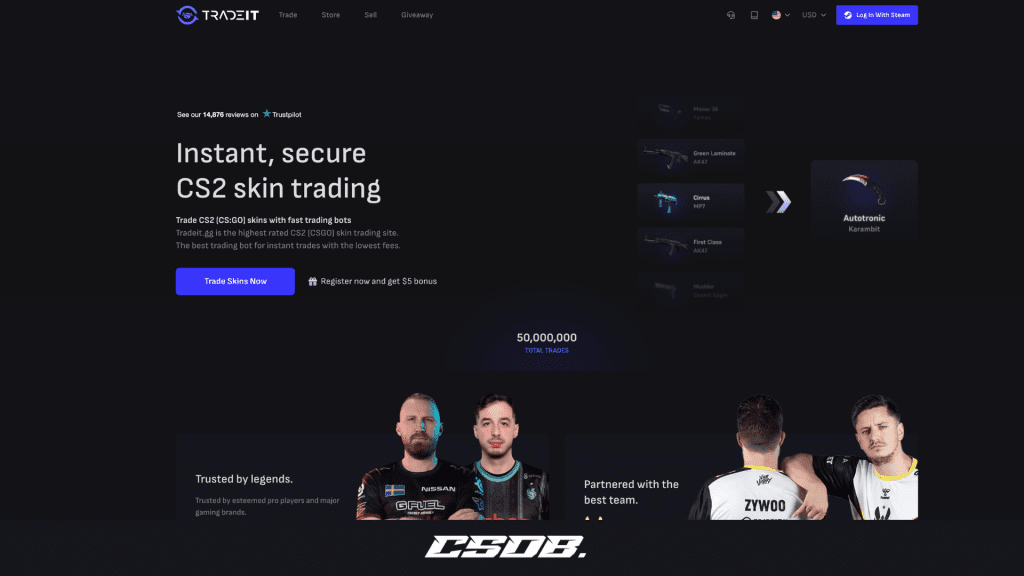

Trade Bots That Won't Steal Your Lunch Money

Discover the safest trade bots that maximize profits without risking your hard-earned cash. Start trading smarter today!

Understanding Trade Bots: How to Choose One That Supports Your Financial Goals

Understanding trade bots can be a game changer for investors looking to enhance their trading strategies. These automated tools are designed to execute trades on your behalf, using algorithms to analyze market data and make informed decisions. However, not all trade bots are created equal. When choosing a trade bot, it's essential to consider factors that align with your financial goals. Start by identifying your investment objectives, whether it's day trading, long-term investing, or a specific niche within the market. This clarity will guide you in selecting a bot that offers features like customizable strategies, risk management tools, and compatibility with your preferred trading platforms.

Once you have established your financial goals, evaluate the available trade bots based on key criteria:

- Performance history: Research the bot's track record and user reviews to ensure reliability.

- User interface: An intuitive and user-friendly interface can make a significant difference in your trading experience.

- Customer support: Opt for bots with robust customer service options to assist you in case of issues.

- Fees and pricing: Analyze the cost of using the bot and ensure it provides value relative to its services.

Remember, the best trade bot for you will align with your individual trading style and risk tolerance while providing the necessary tools to help you achieve sustained success in the financial markets.

Counter-Strike is a popular tactical first-person shooter that emphasizes strategy and team play. Many players are curious about whether is Counter-Strike 2 cross platform capabilities exist, as they wish to connect with friends across different gaming systems.

Top 5 Features of Trade Bots That Minimize Risk

In the ever-evolving landscape of trading, trade bots have emerged as vital tools that help minimize risk for both novice and seasoned traders. One of the top features is automated risk management, which allows traders to set predefined parameters for their investments. This feature enables the bot to automatically close trades when certain loss limits are reached, effectively safeguarding the trader’s capital during market volatility. Additionally, backtesting capabilities allow users to evaluate the performance of trading strategies against historical data, ensuring that only the most effective methods are implemented in real-time trading.

Another key feature of sophisticated trade bots is their use of technical analysis tools, which provide insights based on price movements and volume trends. These tools help traders to identify potential market opportunities and calculate optimal entry and exit points, thereby reducing the chances of emotional decision-making. Furthermore, many bots incorporate diversification strategies by spreading investments across various assets, significantly lowering the risk associated with relying on a single market. Lastly, the ability to utilize real-time data analysis ensures that trade bots can react swiftly to breaking news or market events, further enhancing their capacity to minimize risk.

Are Trade Bots Worth the Investment? What You Need to Know

In the ever-evolving landscape of cryptocurrency and stock trading, trade bots have gained significant attention for their potential to optimize trading strategies and enhance profitability. By automating trades based on predefined criteria, these algorithms can analyze market trends and execute trades much faster than any human trader. However, before you consider investing in a trade bot, it’s essential to evaluate their reliability and the inherent risks involved. While many bots have reported success, not all deliver consistent results, and the market's volatility can lead to substantial losses if not managed properly.

When deciding whether trade bots are worth the investment, it’s crucial to consider several factors:

- Reputation: Research the bot's developer and read user reviews to gauge its effectiveness.

- Cost: Analyze whether the potential returns justify the bot's price and any additional fees.

- Customization: Evaluate if the bot allows for customization to fit your trading style and risk tolerance.