Recipes Rack: Your Culinary Haven

Explore a world of delicious recipes, cooking tips, and culinary inspiration.

Why Your Landlord's Insurance Isn't Enough

Discover the hidden risks of landlord's insurance and why you need better coverage to protect your investment!

The Hidden Gaps in Your Landlord's Insurance Policy

When it comes to protecting your investment property, understanding the hidden gaps in your landlord's insurance policy is crucial. Many landlords assume that their policy covers all potential risks, but this is often not the case. For instance, standard landlord insurance policies typically exclude natural disasters, tenant damage, and liability claims that arise from tenant injuries on the property. It’s essential to review your policy thoroughly and consider additional endorsements or riders to fill these critical gaps. Without adequate coverage, you could face significant financial losses if unforeseen circumstances arise.

Moreover, hidden gaps in your landlord's insurance policy can also include insufficient coverage limits. Many policies have limits that may not reflect current market rents or the value of renovations made to your property. This can lead to underinsurance, where you receive only a fraction of what you need to recover your losses. To avoid such situations, conduct a regular assessment of your property's value and ensure that your insurance coverage aligns with the current market conditions. Taking proactive steps to address these gaps not only safeguards your investment but also provides peace of mind for your rental business.

Is Your Landlord's Insurance Leaving You Vulnerable?

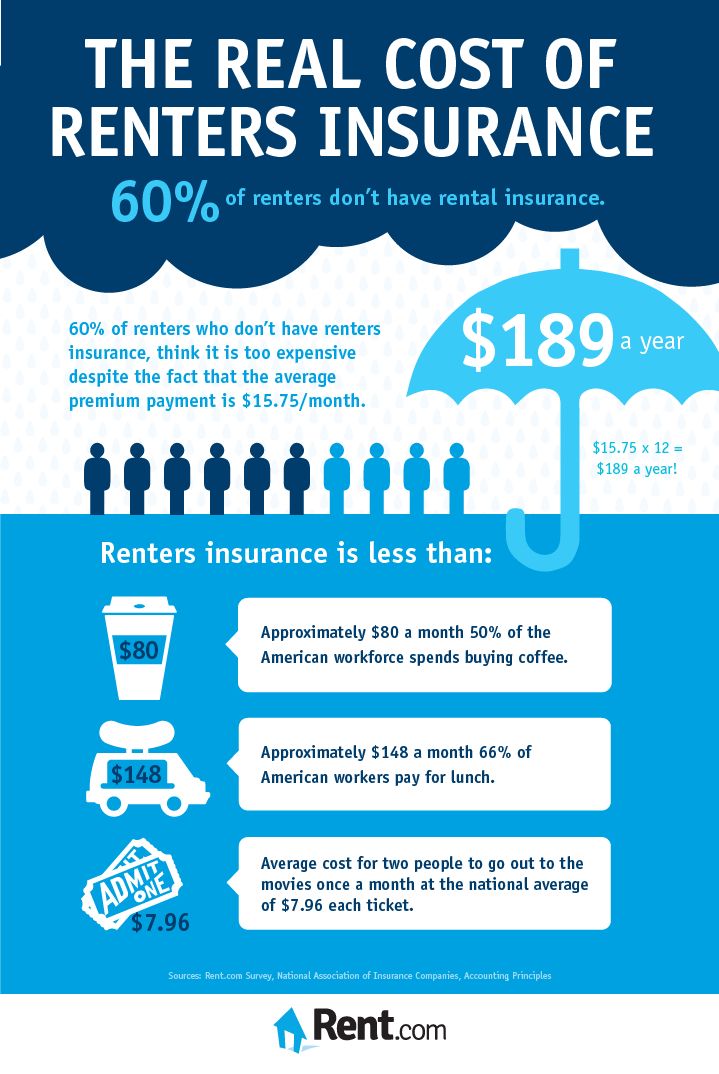

When renting a property, many tenants may assume that their landlord's insurance is sufficient to cover any potential risks. However, landlord's insurance primarily protects the property owner's financial investment rather than the tenant's personal belongings or liability. This can leave you vulnerable in case of accidents, damages, or theft that occur within the rental unit. It’s crucial for tenants to understand the limitations of their landlord's policy and recognize that it does not extend coverage to their personal items.

Furthermore, if the property incurs damage due to natural disasters or negligence, the landlord's insurance might only cover the repair costs while leaving tenants responsible for their own losses. This uncertainty emphasizes the importance of having renter's insurance, which provides protection for personal property and liability coverage that can safeguard against unforeseen events. Consider evaluating your situation by discussing these concerns with your landlord and exploring options for additional insurance that can better protect your interests.

Understanding Additional Coverage Needs Beyond Landlord's Insurance

While landlord's insurance provides a fundamental level of protection for property owners, understanding additional coverage needs is crucial to safeguard against various risks. Typical landlord's insurance covers property damage, liability, and loss of rental income, but it may not address specific scenarios that could lead to financial loss. For instance, natural disasters like earthquakes or floods may require separate policies, as these events often fall outside the standard coverage. Additionally, considering coverage for vacancy periods or tenant-related issues, such as evictions, can further enhance your protection against potential income loss.

Another critical area to explore is personal property coverage. If you provide furniture or appliances for your tenants, standard landlord's insurance may not cover damages to these items. Investing in an endorsement or a separate policy can help you recover costs for repairing or replacing damaged personal property. Furthermore, loss of use coverage is essential if you need to temporarily relocate tenants due to covered repairs, ensuring that you maintain your income stream during disruptions. By understanding these additional coverage needs beyond landlord's insurance, you can better protect your investment and ensure long-term financial stability.